Gold Prices Hit Record High Amid Tariff Uncertainty

- 16th April 2025

- 12:00:00 AM

- 3 min read

Gold’s Glory Run: Record Highs, Sinking Dollar & FII Dilemma – What’s Driving the Surge?

Gold stole the spotlight today, racing to record-breaking levels on the Multi Commodity Exchange (MCX) as global markets tremble under tariff tensions and a sinking dollar. Investors, unnerved by geopolitical uncertainty and weakening currencies, are parking their bets in the ultimate safe-haven asset — and the shine is only getting brighter.

The Dollar’s Decline: A Global Trigger

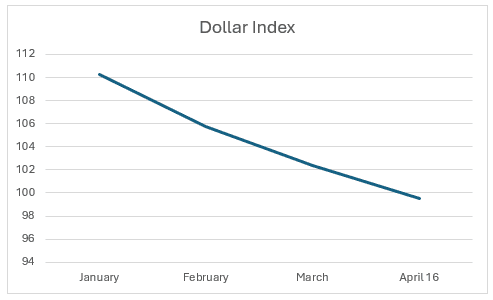

The US Dollar Index, which measures the greenback against a basket of major currencies, has dropped over 8%, falling below the 100 mark from a high of 110 in January. By mid-April, it is trading at its lowest in 2025 so far, even touching a seven-month low against the yen.

This decline has made gold — priced in dollars — more attractive to investors using other currencies, thereby driving up global demand. Meanwhile, anticipation of interest rate cuts, following cooling inflation in both India and the US, has accelerated the momentum behind the gold rally.

Chart: Dollar Index Movement in 2025 (YTD)

Visual representation of the declining Dollar Index from January to April 2025.

Trade Tensions Fuel the Fire

Investor anxiety is being intensified by ongoing tariff measures introduced by US President Donald Trump. As trade uncertainties mount, the demand for safe-haven assets like gold is on the rise. Market observers note that similar policy volatility in the past has driven investors towards defensive assets.

The trade war, particularly with China, continues to cast a shadow over global markets. When combined with persistent inflation concerns, the result has been a sharp uptick in the demand for precious metals.

City-Wise Snapshot: Gold and Silver Prices

| City | Gold (24k) ₹/10g | Gold (22k) ₹/10g | Silver ₹/kg |

| Delhi | 96,320 | 88,300 | 1,00,000 |

| Mumbai | 96,170 | 88,150 | 1,00,000 |

| Kolkata | 96,170 | 88,150 | 99,800 |

| Chennai | 96,170 | 88,150 | 1,10,800 |

Silver too has mirrored gold’s uptrend, trading at ₹1,10,800/kg in Chennai and ₹1,00,000/kg in Delhi and Mumbai.

Rebalancing Act: FIIs Remain Wary

Capital Flows: Glitter Without Gains?

Despite gold’s sparkle, Foreign Institutional Investors (FIIs) remain cautious. India witnessed capital outflows totalling $1.87 billion in April alone, marking one of the sharpest withdrawals among emerging markets. Brazil, Indonesia, and South Korea have all faced similar trends.

Global capital appears to be in a holding pattern. While the combination of a weakening dollar and surging gold prices should, in theory, make emerging markets more attractive, currency volatility and geopolitical tensions are keeping investor sentiment subdued.

Most of the Pain Already Played Out?

While inflation is slowing down and the central banks are are hinting at a more dovish stance, there are signs that the worst may be over. Markets could be nearing a turning point, but investor sentiment remains cautious.

As gold ever brighter in the face of economic uncertainty, a million-dollar question remains: Will this rally be enough to draw global capital back towards India, or is it the start of a longer-term divergence?

For now, gold continues to command center stage- a world’s spectacular symbol in the flux.

PL Capital Desk

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.